Understanding ACA, ACCA, and CIMA

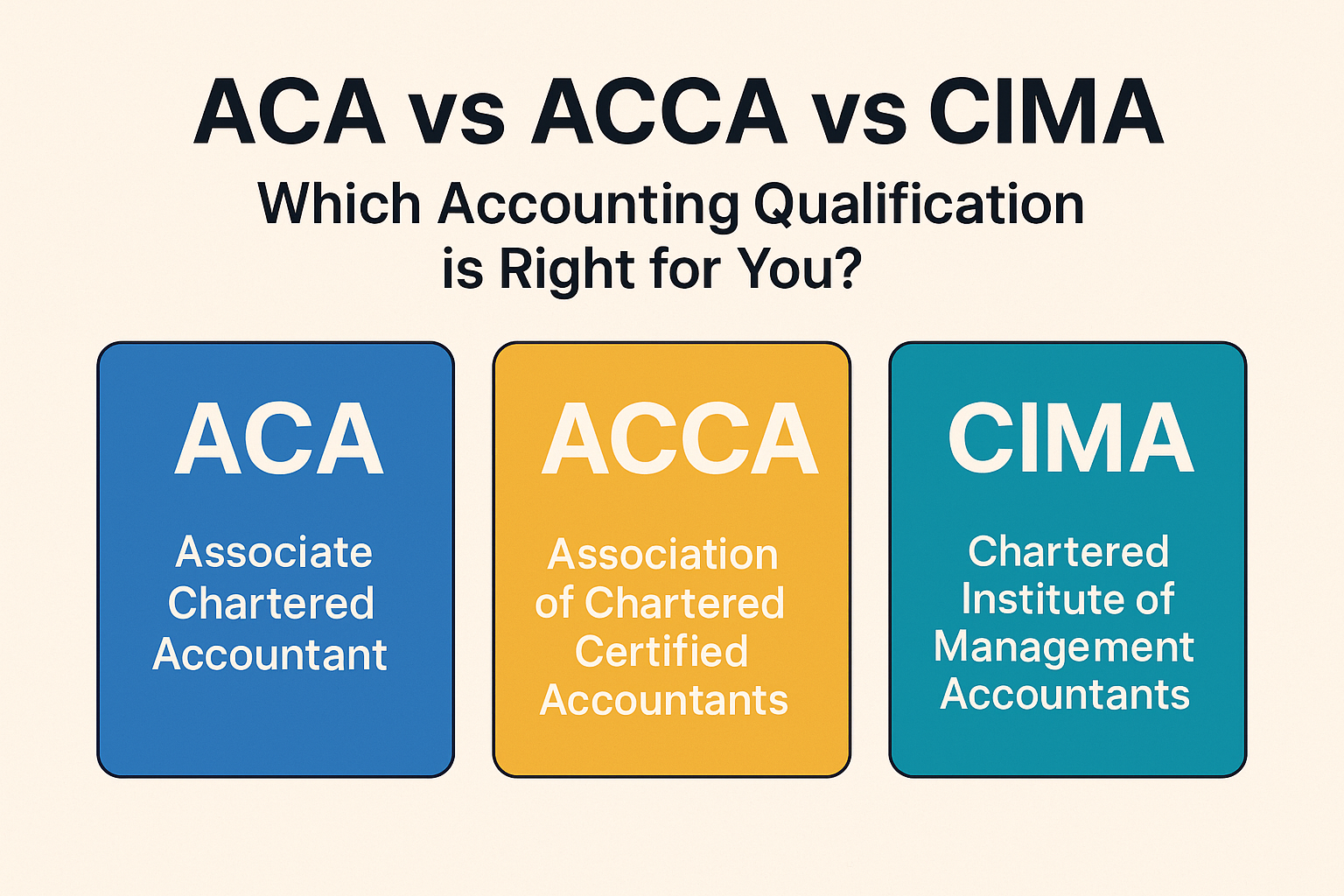

The accounting landscape in the United Kingdom is characterized by several professional qualifications, among which the ACA, ACCA, and CIMA stand out as the most prominent. Each of these qualifications serves a distinct purpose and audience, catering to the diverse needs of students and professionals in the accounting field.

The ACA, or Associate Chartered Accountant, is awarded by the Institute of Chartered Accountants in England and Wales (ICAEW). This qualification primarily emphasizes rigorous training in areas such as financial accounting, tax, assurance, and auditing. The ACA is often regarded as a traditional route for those aspiring to work in audit firms, corporate finance, or as tax advisors. It requires candidates to complete a series of assessments and accumulate practical experience, ensuring that graduates possess both theoretical knowledge and practical application skills. Historically, the ACA has maintained a prestigious status since its inception in 1880, focusing on cultivating high standards in accounting practices.

In contrast, the ACCA, established in 1904, is a global professional accounting body that is known for its versatility. The Association of Chartered Certified Accountants provides a qualification that covers a broader range of topics, including management accounting, taxation, and financial management, alongside financial reporting. The ACCA aims to produce competent financial professionals equipped to work in various sectors, including public practice, commerce, and industry. This qualification is particularly valuable in an increasingly globalized economy, facilitating international career opportunities for graduates.

On the other hand, the CIMA, or Chartered Institute of Management Accountants, emphasizes management accounting as a distinct discipline. Founded in 1919, the CIMA qualification is widely recognized for its focus on preparing professionals to work within organizations, aiding strategic decision-making through financial insights. This qualification covers key areas such as management control, performance management, and risk management, making it particularly relevant for professionals interested in roles that integrate financial and business management.

In summary, the ACA, ACCA, and CIMA each play vital roles in shaping the accounting profession in the UK. Understanding their unique attributes and historical significance can guide aspiring accountants in selecting the most suitable qualification aligned with their career objectives.

Pros and Cons of ACA, ACCA, and CIMA

When considering accounting qualifications, students often evaluate the pros and cons of each path to determine which aligns best with their career aspirations and personal circumstances. The ACA (Association of Chartered Accountants), ACCA (Association of Chartered Certified Accountants), and CIMA (Chartered Institute of Management Accountants) each present unique advantages and challenges.

Starting with the ACA, one significant advantage is the qualification’s high regard within the UK, especially among top-tier accounting firms. It is known for its rigorous training in financial accounting and audit practices, providing in-depth knowledge essential for a career in audit roles. However, the challenge lies in its demanding structure, necessitating a significant time commitment to complete its rigorous examination process. Furthermore, the associated costs for exams and training can be burdensome, which may be a deterrent for some students.

On the other hand, the ACCA is celebrated for its global recognition and the versatility it offers. This qualification supports a wider array of roles within the accounting and finance sectors, allowing graduates to work in diverse environments. Among its drawbacks, the ACCA’s extensive syllabus can be overwhelming and requires diligent study habits. Moreover, the examination frequency may create pressure on students balancing work and study commitments.

CIMA, tailored specifically for management accounting, enhances strategic decision-making skills valuable in corporate environments. This specialized training appeals to those interested in business management or consultancy. Nonetheless, aspiring CIMA candidates face similar challenges regarding the time investment needed to finish the qualification. The costs of exams and study materials can add an additional layer of financial strain as well.

Ultimately, while the ACA, ACCA, and CIMA all offer distinct advantages, they also present challenges that require careful consideration. Each path demands investment in terms of time and finances, which students must weigh against their career goals.

Career Paths and Salary Comparisons for ACA, ACCA, and CIMA

In the realm of accounting qualifications, different certifications, such as ACA (Associate Chartered Accountant), ACCA (Association of Chartered Certified Accountants), and CIMA (Chartered Institute of Management Accountants), present distinct career trajectories for graduates in the UK. Understanding the unique career paths associated with each qualification can greatly influence a student’s choice based on their professional aspirations.

Starting with the ACA qualification, it is primarily geared towards those looking to pursue a career in audit and taxation. Typically, ACA professionals often find employment within prestigious accounting firms, engaging in activities related to external audits and compliance reviews. As these individuals gain experience, they typically advance to senior managerial roles, where they may oversee audit teams or manage significant client accounts. The earning potential in these senior positions is noteworthy, with average salaries reaching upwards of £70,000 annually, depending on the firm and location.

On the other hand, ACCA offers broader opportunities across various sectors, making it an attractive option for those interested in both practice and industry roles. ACCA graduates can work in areas such as financial accounting, management accounting, and taxation. Entry-level positions for ACCA members often start around £28,000 to £32,000 per year, while experienced professionals can earn between £50,000 to £80,000, particularly as they transition into financial controller or finance director roles.

Meanwhile, CIMA focuses specifically on management accounting, preparing professionals for roles that require strategic financial management skills. CIMA graduates are well-suited for positions in corporate finance, budgeting, and financial planning. Initial salaries for CIMA-qualified accountants are competitive, generally ranging from £30,000 to £40,000, with experienced professionals reaching upwards of £100,000 in senior financial management roles.

In summary, each qualification presents unique career paths and potential salary brackets that cater to different areas of expertise within the accounting sector. Understanding these distinctions is vital for students when navigating their professional journeys in the diverse landscape of accounting careers in the UK.

Ideal Candidate Types for ACA, ACCA, and CIMA

When evaluating the ideal candidates for the ACA, ACCA, and CIMA certifications, it is essential to consider various factors such as learning styles, professional aspirations, and particular interests within the accounting domain. Each of these qualifications caters to distinct professional paths and personal attributes, guiding prospective students in their decision-making process.

The ACA (Associate Chartered Accountant) is tailored for individuals who aspire to work in audit and assurance, taxation, or advisory roles within accounting firms. Candidates considering ACA should possess a strong analytical mindset, thrive in structured environments, and appreciate rigorous technical training. Those who prefer a traditional learning approach, alongside a strong emphasis on professional ethics and standards, may find ACA the most suitable route for their careers.

In contrast, the ACCA (Association of Chartered Certified Accountants) attracts candidates with an interest in a broad range of accounting functions, including financial reporting, compliance, and consultancy. Ideal candidates for the ACCA path are typically adaptable and open-minded, with a desire for global opportunities. The flexible study options and diverse career pathways associated with ACCA appeal to those who value practical experience and wish to work in varying sectors such as corporate finance or public accounting.

Lastly, individuals drawn to the CIMA (Chartered Institute of Management Accountants) often have a keen interest in management accounting and strategic decision-making. Candidates suited for CIMA typically excel in a business-oriented environment and have an affinity for analyzing financial data to drive business performance. They prefer a curriculum focused on management strategies, operational performance, and organizational success.

Owner’s Thoughts – Elliot’s Take

When I was weighing up which path to take, I remember how overwhelming it felt. ACA seemed intense — and it is. But I chose it because I wanted the prestige, structure, and the challenge that comes with working in practice. I’m currently in practice myself, and ACA felt like the best fit to fully immerse myself in the world of accounting — tough exams, hands-on experience, and diving straight into the deep end.

But no matter which path you choose, the real key is aligning it with your long-term goals, not just picking what sounds impressive.

That’s exactly why I built Greigster — to give accountants a space to showcase their journey, connect with others, and find opportunities that match their qualifications. A platform built for us, by someone who’s walking the same path.