Salary Ranges at Different Career Stages

When considering which qualification aligns best with your career goals in accounting, it is essential to evaluate the focus areas of ACA, ACCA, and CIMA, as they each offer unique advantages and pathways for career progression and salary potential in the UK.

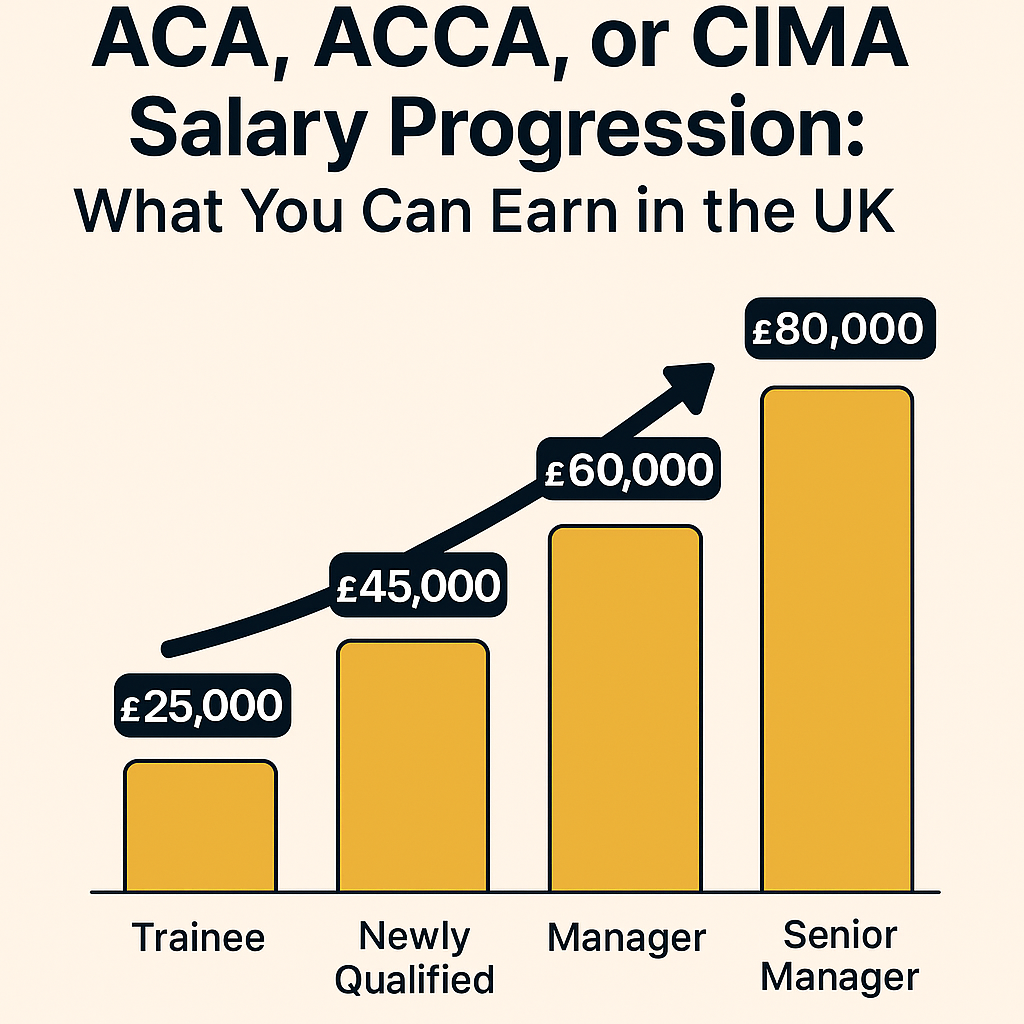

The salary landscape for accounting professionals in the UK varies significantly depending on their qualification and career stage. For those embarking on their careers, typically classified as trainee accountants, the starting salaries range from £22,000 to £30,000 annually. This initial phase often involves gaining practical experience while pursuing a professional qualification such as ACA, ACCA, or CIMA. The trainee accountant salary in the UK can also be influenced by the size of the firm and geographic location, with larger firms, particularly the Big 4 accounting firms, generally offering higher remuneration packages.

Once the individual has obtained their qualification and has become newly qualified, the average salary can increase substantially. Newly qualified accountants can expect to earn between £40,000 and £50,000 annually, particularly if they are ACA or ACCA qualified. Similarly, those with a CIMA qualification may see a comparable salary, reflecting the recognition of their capabilities in financial management and strategy. At this stage, individuals may also have opportunities to specialize in certain areas, which can further enhance their earning potential.

As accountants progress to managerial positions, typically within five to ten years of experience, salaries can rise significantly, ranging from £50,000 to £70,000. Senior roles, such as finance manager or senior accountant, often command even higher salaries, often exceeding £80,000, especially in prominent organizations or sectors. The highest paying accounting qualifications and roles can be accessed through continuous professional development and specialization. Ultimately, the salary progression for chartered accountants and other professionals in finance reflects a combination of qualification type, experience, and the specific demands of their roles.

Comparative Salary Analysis: A Table Overview

Understanding salary progression across various accounting qualifications is essential for aspiring accountants in the UK. The table below presents a comparative analysis of the salary ranges for ACA, ACCA, and CIMA accountants at different stages of their careers. The data is categorized into trainee, newly qualified, and experienced levels, providing a comprehensive overview of the financial prospects associated with each accounting qualification.

| Career Stage | ACA Salary UK | ACCA Salary UK | CIMA Salary UK |

|---|---|---|---|

| Trainee Accountant | £22,000 – £30,000 | £20,000 – £28,000 | £18,000 – £25,000 |

| Newly Qualified Accountant | £40,000 – £50,000 | £35,000 – £45,000 | £38,000 – £48,000 |

| Mid-Level Accountant | £50,000 – £70,000 | £45,000 – £65,000 | £48,000 – £68,000 |

| Senior Accountant | £70,000 – £90,000 | £65,000 – £85,000 | £68,000 – £88,000 |

These figures illustrate the significant earning potential associated with each accounting qualification in the UK. It is crucial to note that factors such as industry, geographical location, and employer size can cause variations in salary figures. For instance, accountants in big four accounting firms tend to earn higher salaries compared to those in smaller firms. Furthermore, with experience and further qualifications, salary progression for each pathway can lead to substantial financial rewards.

In summary, selecting the right accounting qualification can greatly influence your earning potential, with the ACA, ACCA, and CIMA salaries demonstrating various trajectories that are reflected in the salary comparison table. Understanding these pathways will help prospective accountants make informed decisions regarding their careers in the accounting field.

Factors Influencing Salary: Location, Industry, and Employer Size

When considering the salary progression for professionals holding ACA, ACCA, or CIMA qualifications, several crucial factors come into play. One of the most significant determinants is geographic location within the UK. For instance, accountants based in London typically command higher salaries compared to those in other regions. This disparity is often attributed to the higher cost of living in the capital and the concentration of major financial institutions that require qualified accountants. According to recent data, newly qualified accountants in London can expect to earn upwards of £40,000, while those in other parts of the UK may start at around £30,000.

The industry also plays a pivotal role in salary determination. Certain sectors, such as investment banking and financial services, tend to offer higher compensation packages compared to public sector roles or small businesses. For example, a chartered accountant working for a Big 4 accounting firm in the UK might earn significantly more than a trainee accountant employed by a local firm. Furthermore, as accountants progress in their careers within industries that are known for higher wages, such as technology or pharmaceuticals, their earning potential escalates more noticeably. Each industry has its own benchmarks, with financial services often leading the pack in terms of accountant salary progression.

Employer size is another critical factor in determining salaries. Large multinational companies usually offer better remuneration packages and additional benefits compared to smaller firms. For instance, professionals at larger firms may receive bonuses and opportunities for international placements, which can significantly enhance their overall financial compensation. In contrast, smaller firms may provide a more modest salary but could offer a better work-life balance and the potential for rapid advancement through the ranks. Ultimately, the combination of location, industry, and employer size creates a multifaceted landscape for salary progression, influencing the earning potential of ACA, ACCA, and CIMA qualified accountants across the UK.